TradeTerminal

A universal trading terminal for Bybit and Binance with CLI interface and client-server architecture, designed to minimize exchange latency. Built in Rust, the project provides a powerful toolkit for professional cryptocurrency trading.

Key Features

Trading Operations

- Order Placement: Market and Limit orders with fast execution

- Risk Management: Automatic position sizing based on USDT risk with exchange fee consideration

- Take Profit: Exit position setup as percentage from entry

- Trailing Stop: Flexible trailing stop system with support for:

- Absolute price values and callback in dollars

- Percentages from current price

- Ratios for activation based on distance to Stop Loss

- Auto-Stop (AS): Smart exit on active markets

- Click on price to copy it for quick input

- Trigger activates when price or percentage is reached

- Liquidity timer (2 sec) - closes position if trading stops

- Perfect for profit taking on volatile moves

- Hedge Mode: Support for simultaneous Long/Short positions on the same instrument

Interface and Management

- CLI Interface: Convenient command line with command shortcuts

- Pipe Operator: Combine commands via

|to create complex scenarios- Example:

:br 10 94000 | ts 2% 0.5%- open position and immediately set trailing stop

- Example:

- Command Chains: Sequential execution via

;- Example:

:ca; br 10 94000- cancel all orders and open new position

- Example:

- State Viewing: Display open orders, active positions and current balance

- Order Management: Cancel individual orders or all at once

- Multi-symbol: Quick switching between trading pairs

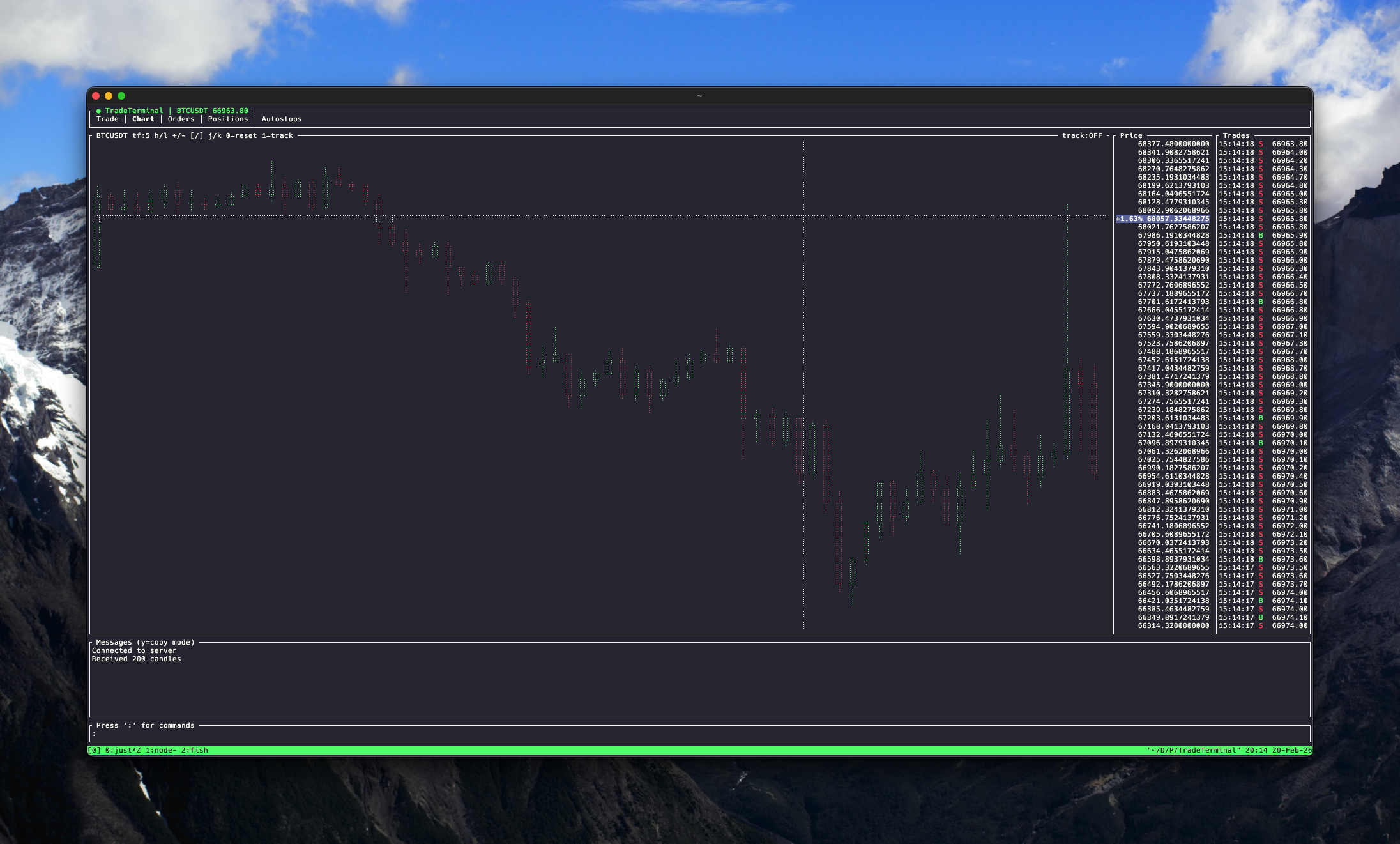

Chart and Visualization

- Built-in Chart: Interactive chart with multiple timeframe support

- Sub-second Timeframes: Unique ability to work with 1s, 5s, 10s, 30s timeframes

- Uses real tick data from the exchange

- Aggregation happens on client for maximum accuracy

- Displays real trades without additional server load

- Standard Timeframes: From 1 minute to daily candles (15m, 1h, 4h, D, etc.)

- Price Levels: Add and remove horizontal levels

- Navigation: Scroll history, zoom, auto-follow last price

- Sound Indication: Optional audio signals on exchange trades

- High tone - buy, low - sell

- Frequency increases with trading activity

Architecture

- Client-Server: Logic separation for latency optimization

- WebSocket: Persistent connection for instant data reception

- Auto-update: Automatic position and order data updates

- Docker Support: Easy VPS deployment to minimize latency to exchange servers

Technology Stack

- Language: Rust (high performance and memory safety)

- Protocol: WebSocket for real-time communication

- Exchanges:

- Bybit API v5 (Testnet and Production)

- Binance API (Spot and Futures)

- Deployment: Docker, Docker Compose

- UI: TUI (Text User Interface) with tab support

Position Size Calculation

The terminal uses an advanced calculation formula that accounts for exchange fees:

quantity = risk_usdt / (|entry_price - sl_price| + entry_price * fee * 2)

Parameters:

- Taker fee: 0.055%

- Maker fee: 0.02%

- Fee multiplied by 2 (entry + SL exit)

Example:

- Risk: $10

- Entry: 95000, SL: 94000

- Difference: $1000

- Fee cost: 95000 × 0.00055 × 2 = $104.5

- Total risk per unit: $1104.5

- Quantity: 10 / 1104.5 = 0.00905 BTC

Trailing Stop: Activation Types

Absolute Price

:ts 97000 500 - activate when price reaches 97000, callback $500

Percentage

:ts 2% 0.5% - activate on 2% growth from entry, callback 0.5% from current price

Ratio

:ts 1/3 2% - activate at distance 3 times greater than to Stop Loss

Formula: trigger = entry ± (|SL - entry| × denominator/numerator)

Example:

- Entry: 100

- SL: 101 (1% risk)

- Ratio:

1/3 - Trigger: 103 (3 times further from entry than SL)

- Then TS moves with 2% callback from current price

Terminal Commands

Basic Orders

:buy 0.01 # Market buy 0.01 BTC

:buy 0.01 95000 # Limit buy @ 95000

:sell 0.01 # Market sell

:sell 0.01 96000 # Limit sell @ 96000

Orders with Risk Management

:buyrisk 10 94000 # Long market, $10 risk, SL @ 94000

:buyrisk 10 94000 95000 # Long limit @ 95000

:buyrisk 10 94000 - 2 # Long market + TP 2%

:sellrisk 10 96000 # Short market, $10 risk, SL @ 96000

:sellrisk 10 96000 95000 # Short limit @ 95000

:sellrisk 10 96000 95000 1.5 # Short limit + TP 1.5%

Trailing Stop

:ts 2% 0.5% # Activation +2%, callback 0.5%

:ts 97000 0.5% # Activation @ 97000, callback 0.5%

:ts 2% 500 # Activation +2%, callback $500

:ts 1/3 2% # Activation on 1:3 ratio from SL, callback 2%

Auto-Stop

:as 2 0.545 # 2 sec timer, trigger @ 0.545

:as 2 0.2% # 2 sec timer, trigger +0.2%

Logic:

- Price can be copied by clicking in the interface

- When trigger is reached, liquidity timer starts

- If no trades occur on exchange in 2 seconds - position closes

- Profit protection on fast moves with subsequent fade

Combo Commands

:br 10 94000 | ts 2% 0.5% # Long + trailing stop

:sr 10 96000 | ts 2% 0.5% # Short + trailing stop

:ca; br 10 94000 # Cancel all + new order

Chart

:chart # Open chart

:tf 1s # 1 second timeframe

:tf 5s # 5 second timeframe

:tf 15 # 15 minute timeframe

:tf D # Daily timeframe

:level 95000 # Add level

:levels # Clear levels

:sound # Toggle trade sound

Management

:cancel abc123 # Cancel order

:cancelall # Cancel all orders

:symbol ETHUSDT # Change symbol

:help # Help

Command Shortcuts

:b=:buy:s=:sell:br=:buyrisk:sr=:sellrisk:ts=:trailing-stop:as=:auto-stop:c=:cancel:ca=:cancelall:sym=:symbol:h=:help

Navigation

Main Interface

:- Command input modeTab- Switch tabsr- Refresh dataEsc- Exit input modeq- Exit programCtrl+C- Force exit

Chart

h- Scroll left (back in time)l- Scroll right (forward in time)+/=- Zoom in-- Zoom out0- Reset to last candles

Deployment

Local Run

- Clone repository

- Create

.envfile with API keys:

BYBIT_API_KEY=your_api_key

BYBIT_API_SECRET=your_api_secret

BYBIT_TESTNET=true

- Start server:

cargo run --bin trade-server - Start client:

SERVER_URL=ws://127.0.0.1:9000 cargo run --bin trade-client

VPS Deployment

To minimize latency, it's recommended to place the server in a region close to exchange servers (Bybit/Binance: Singapore, Tokyo):

- Install Docker on VPS

- Create

.envwith API keys - Run:

docker-compose up -d - Connect client:

SERVER_URL=ws://vps-ip:9000

Use Cases

This tool is useful for:

- Professional cryptocurrency trading with minimal latency

- Scalping and intraday trading

- Automating trading strategies via pipes and command chains

- Testing trading ideas on Testnet

- Remote trading via VPS

Open Source

Released under MIT license. The project demonstrates professional practices for developing high-performance Rust applications and can serve as an educational resource for learning:

- Client-server architecture on WebSocket

- Working with exchange APIs

- TUI application development

- Trading risk management

Links

- Status: In development (private repository)

- Technologies: Rust, WebSocket, Docker, Bybit API, Binance API

- License: MIT